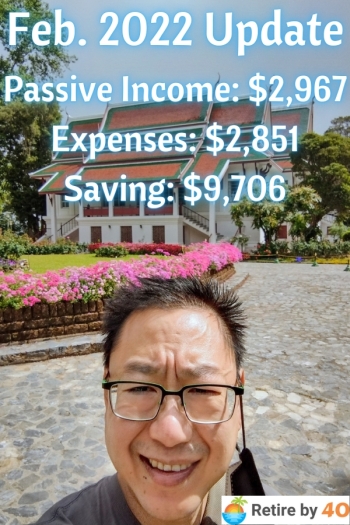

Hey, everyone! Sheesh, what a crazy month. Russia invaded Ukraine and the stock market threw a fit. I’d invest more if I was at home, but it’s very difficult to react that quickly while I’m in Thailand. Vanguard won’t let me log in. I have to call them to make any transaction. Anyway, it isn’t a big problem. Our portfolio is set. Any changes I make won’t affect our total portfolio that much. I’m more concerned about the Ukrainians. Hopefully, they’ll get through this okay.

On the personal finance side, February was a good month. Our income was solid and our expenses were low again. I spent a bit more in Thailand, but that was mostly for a place to stay. Here is a quick breakdown of my travel spending.

Travel spending – $640

- $200 – Food, drinks, and groceries.

- $300 – Condo for March

- $140 – 8 nights of hotel stays.

Our net worth was okay. It went down a bit, but recovered at the end of February. Things are going well for us.

Today, I’ll share how I’m doing on my New Year goals (badly) and update our monthly cash flow. Here are the details.

2022 Goals

Here is my 2022 goal spreadsheet. It works really well. Try it out if you can’t keep up with your New Year goals. The key is to go over the spreadsheet at least once a month to track your progress. That way, you can see which goals need extra attention.

Heh, I’m not doing so well on my goals this year. I already failed 3 of them. See the reason below.

Financial Goals

- Real Estate Crowdfunding $200,000. This goal was a bit too ambitious. I need to extend the timeline to 2023. This year, I’ll just try to hit $160,000, that’s about half way. Recently, the projects on CrowdStreet completed funding very quickly. Investors are taking profit from the stock market and diversifying. It’s a great way to passively invest in real estate.

- FI Ratio > 110%. This is my main goal for 2022. The FI ratio is passive income divided by expense. So far, our FI ratio is 113%. That’s really good. This year, I’m less focused on our passive income because Mrs. RB40 plans to work longer. I’ll try to keep our passive income stable at around 110%.

- Sell rental condo. Our tenant decided to stay for another year. He’s a great tenant so I’m okay with it. The price isn’t great in that area anyway. Portland is still struggling with a lot of issues. Hopefully, the city will improve in a year. Anyway, I failed on this goal.

- Speculate crypto $10,000. This isn’t going too well. Crypto seems to track the stock market pretty closely. I need to do more research and see why. Cryptocurrency will be very volatile in the short term so hang on if you have a lot of money invested.

Health Goals

- Unfortunately, I lost my fitness tracker in Bangkok. I have no idea how it happened. It probably just popped off my wrist. Oh well, I’ll see if I can pick up another tracker when I get home. But I lost all motivation for now. I’m eating like crazy in Thailand because the food is so cheap and delicious. I’ll lose weight later. I’m walking a lot too so I’m burning calories.

Fun Goals

- Travel 180 days – I got 48days in the bag. It would be more fun if my family was here, but Mrs. RB40 is busy with work and RB40Jr with school. She could retire if she wants, but she chooses to work. I’ll just solo travel when I can. We’ll travel together in the summer.

- 1,000 subscribers on my YouTube channel. Currently, we have 512 subscribers on our YouTube channel. I’m publishing several clips per week so I hope to gain more traction this year.

- Hot air balloon ride, zip line, and Disneyland. I’ll work on this when I get back to Portland. Hot air balloon ride near Portland. Zip line in Thailand in the summer. Disneyland in the fall.

- Happiness level > 8. I’m having a great time in Thailand and I’m not even spending much money. In February, I give it a 9. I got to see my parents and relatives. I ate a ton of delicious food. Life is good. The only problem is my mom. Her dementia is deteriorating. She’ll have to go to a nursing home soon. It’s sad, but that’s the price of getting old. I found a place that looks pretty good. We’ll try them out soon.

Net Worth (-3.9% YTD)

I’ve been tracking our net worth since 2006. It is very motivating to see our progress. The power of compounding is unbelievable. Our net worth increases more than we earn almost every year. Although, 2022 might not work out so well. The stock market dropped quite a bit since the beginning of the year. Our net worth followed the market down and dropped about 4%. I think that’s all right, though. The stock market increased so much last year. It needs to calm down a little. I’m surprised it came back so quickly with the ongoing Ukraine invasion.

Here is a chart of our net worth from Personal Capital. Sign up for a free account at Personal Capital to help manage your net worth and investment accounts. I log in almost every day to check on our accounts. It’s a great site for DIY investors.

2022 Passive Income ($6,513 YTD)

Here is a quick summary of our passive income. You can see all the details on my Passive Income page.

February was a slow month for passive income. Next month should be better. Fortunately, we didn’t spend much so our FI ratio still looks good.

*FI ratio = passive income/expense

February 2022 Cash Flow

Our cash flow was good in February. Our income was solid on all fronts. Oh, my scooter side hustle is done. LIME is moving to a new model and fired all the juicers. Oh well, it was fun while it lasted. I’ll look for a new side gig at some point. Last month, we didn’t spend much. Overall, it was a good month.

Here is the Sankey diagram of our February cash flow. You can get a quick overview from the diagram and see the details below.

Gross Income: $15,188

Our gross income will be lower than usual this year. We plan to work less and travel more.

- Mrs. RB40’s job: $10,109. Mrs. RB40’s income was higher than usual this month. She got reimbursed for previous travel related expenses.

- Blog income: $3,026. My blog income was higher than usual as well. I finally got paid for a sponsored post I worked on last summer.

- Real estate crowdfunding: $139. It was a slow month for Real estate crowdfunding. You can read more at the RE Crowdfunding Passive Income page.

- Rental income: $717. We had nice month at the rental. I think we’ll have a good year with rental income. Things are smoother than previous years. Read more at the Rental Property Passive Income page.

- Dividend Income: $996. See more details on my Dividend Passive Income page.

- Interest Income: $1.

- Side hustle & Misc: $200. Mrs. RB40 deposited $200 at the ATM. I think it was a gift from her dad.

Monthly Spending: $2,851

This year, I plan to spend about $50,000. So our monthly spending budget is $4,166/month. In February, we were well under budget. We didn’t have any big expense. My travel doesn’t cost that much so that was good. Here are the details.

- Housing: $1,328. This category includes mortgage, home insurance, HOA fees, property taxes, utilities, home improvement, repair, and furnishing.

- Parents: $250. My brothers and I each sent $250/month to my parents. They don’t have much retirement savings. Fortunately, they live in Thailand so it is enough. I also own the condo they live in so their housing expense is minimal.

- Groceries: $330. Usually, we spend about $500/month on groceries. Mrs. RB40 was using up all the stuff in the pantry so she didn’t spend much.

- Bills: $23. (This is just life insurance. Water, gas, and electric bills are included in the housing category.)

- Transportation: $129. This category includes gasoline, insurance, public transportation, and car maintenance.

- Entertainment: $128. Mrs. RB40 and Junior got takeout a few times.

- Kid: $1.

- Travel: $640. Most of this is for the hotel and condo. Food is very affordable. I usually eat out once per day.

- Health: $12.

- Clothing: $10.

- Misc: $0.

Others

I don’t count these as personal spending.

- Taxes and deductions: $2,630.

2022 Savings ($19,704 YTD)

I don’t think we’ll save as much as usual this year. We plan to travel more and relax a bit. We’ve been saving for so long. I think we deserve a break.

- Joe’s 401k: $1,800.

- Mrs. RB40’s 401k: $3,000. She contributes $750 every paycheck. She’ll need to increase it this year, though. I’ll send her a message.

- Roth IRAs: $2,000.

- 529 College Savings: $0.

- Extra savings: $12,904

YTD 2021 saving rate = 65%

February 2022 wrap up

February was a volatile month. As the Covid situation began to improve, Russia invaded Ukraine. What a mess. Most of us are not affected directly except for the higher gas price, but I still feel for the people. War is never good. Anyway, we are doing fine financially. We spend very little in the winter so our cash flow is good. Even with my travel, we came in way under budget. Let’s just keep calm and invest more.

How was February for you? Did you have a nice 2022 so far?

*Sign up for a free account at Personal Capital to help manage your net worth and investment accounts. I log in almost every day to check on our accounts. It’s a great site for DIY investors.

Disclosure: We may receive a referral fee if you purchase or signup for a service through the links on this page.

The post February 2022 FIRE Update appeared first on Retire by 40.

Source: Retire By 40

Republished by Blog Post Promoter